MoMo Restructuring Protects Value And Paves Way For Future Listing – MMF Chairperson Assures Shareholders

Chairperson Victoria Bright Says MoMo Restructuring Safeguards Investments And Prepares Company For A Future GSE Listing

- Restructuring aims to protect shareholder value and ensure future growth

- Move aligns with Ghana’s requirement for 30% local ownership in fintech businesses

- MoMo business expected to list on the Ghana Stock Exchange within 3–5 years

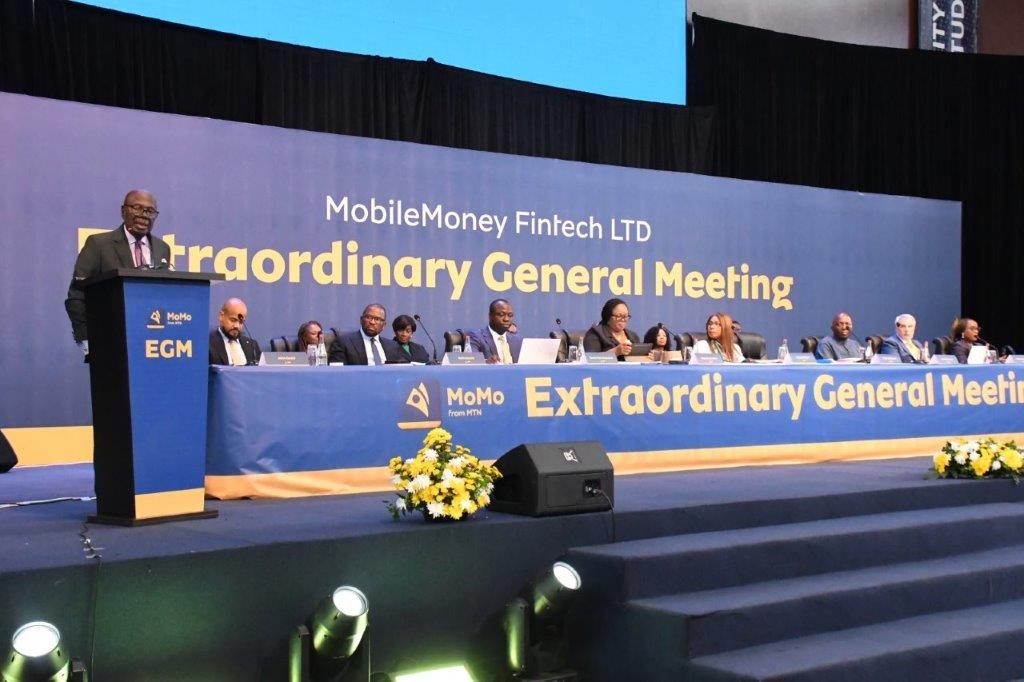

Madam Victoria Bright, Chairperson of MobileMoney Fintech LTD (MMF), has assured shareholders that the ongoing restructuring of the Mobile Money (MoMo) business is designed to protect the value of their investments while positioning the company for future growth and an eventual listing on the Ghana Stock Exchange (GSE).

She explained that the restructuring also aligns with the requirements of Ghana’s Payment Systems and Services Act, 2019 (Act 987), which mandates at least 30% Ghanaian ownership for all dedicated electronic money issuers.

Speaking at the Extraordinary General Meeting (EGM)—held both virtually and in person on Monday, December 1, 2025, at the University of Professional Studies Auditorium in Accra—Madam Bright noted that although MMF is newly incorporated, it is built on more than a decade of innovation and impact driven by Mobile Money Limited (MML).

She highlighted that MMF has two shareholders: MTN Dutch Holdings B.V., representing MTN Group’s interest, and the MTN Ghana Fintech Trust (the Trust), which holds the interests of all minority shareholders of Scancom PLC. The Trust safeguards their rights and value and ensures transparent representation until the MoMo business is listed on the GSE. According to her, MMF will provide the right structure, strategic focus, and enhanced governance to create long-term value for all stakeholders.

On the subject of shares and dividends, Madam Bright explained that the shareholding structure of Scancom PLC will be mirrored in MMF. After the future listing, beneficiaries will hold their shares directly in both Scancom PLC and MMF and will continue to receive dividends from each company. Until then, voting rights in the MoMo business will be exercised on their behalf through the Trust, based on their instructions.

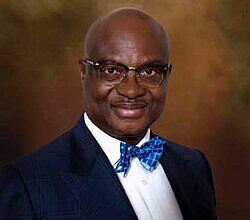

Dr. Ishmael Yamson, Board Chairman of Scancom PLC, also addressed the gathering. He described the MoMo business as one of the company’s strongest drivers of growth, innovation, and financial inclusion. He emphasized that properly localizing the business is an investment in its future and in the future of shareholders. Dr. Yamson added that the new structure sets a clear pathway and timeline for the MoMo business to be listed within the next three to five years.

Following the overwhelming approval by MMF beneficiaries and shareholders in favour of the merger between MMF and MML, Madam Bright announced that Scancom PLC will now begin the necessary processes to finalize the merger. Completion of the process, she noted, is subject to final regulatory approvals, including authorization from the Bank of Ghana.