BoG Confirms GH¢5.6bn Loss in 2024 Gold-for-Reserves Programme

RTI disclosure reveals escalating losses under Domestic Gold Purchase and Gold-for-Reserves programmes amid calls for accountability

- Bank of Ghana reports GH¢5.662 billion loss under the Gold-for-Reserves (G4R) and Domestic Gold Purchase Programmes (DGPP)

- Total confirmed losses since 2022 exceed GH¢7.1 billion, including Net G4O, Net G4R, and ASM-related gold losses

- Despite financial setbacks, the Bank maintains the initiatives aim to stabilize the currency

The Bank of Ghana (BoG) has confirmed that Ghana incurred substantial losses under the Domestic Gold Purchase Programme (DGPP) and its Gold-for-Reserves (G4R) framework in 2024, with total losses for the year amounting to GH¢5.662 billion.

The disclosure was made in a formal response to a Right to Information (RTI) request submitted by Asempa FM. It comes days after the Minority in Parliament, on January 8, 2026, accused BoG Governor Dr. Johnson Asiama of oversight failures following the controversial $214 million loss linked to the programme.

According to the Minority, public trust in Ghana’s financial institutions hinges on transparency and accountability, warning that unaddressed losses could erode confidence in the Bank of Ghana and the broader financial governance framework.

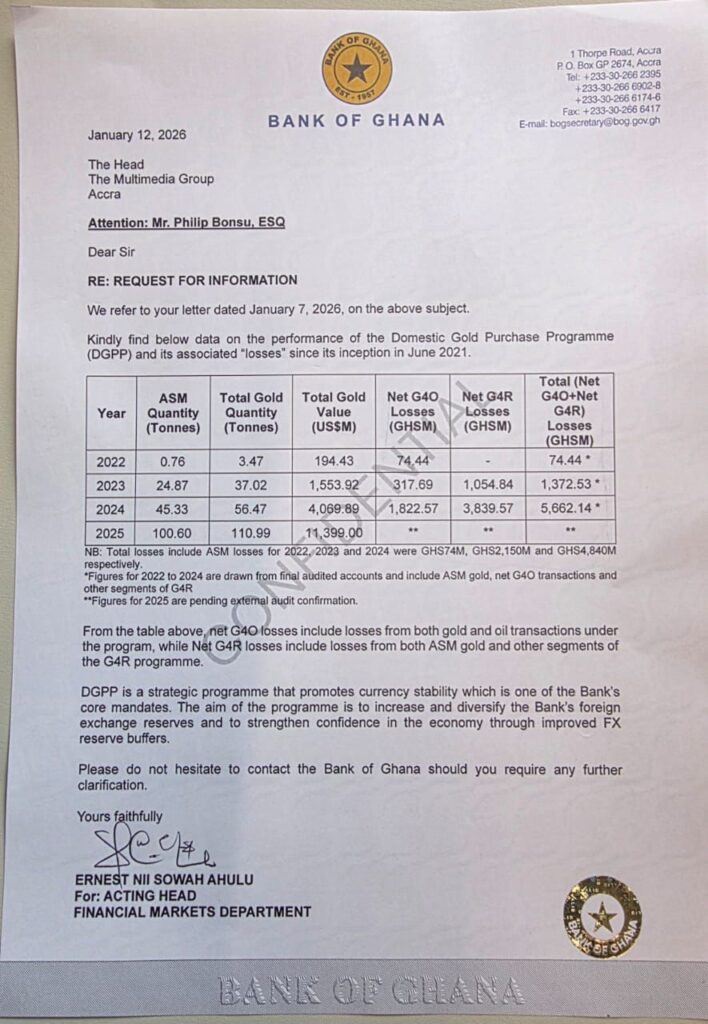

The letter, signed by Ernest Nii Sowah Ahulu on behalf of the Acting Head of the Financial Markets Department, detailed losses recorded since the programme’s launch in June 2021. The figures show escalating losses:

-

2022: GH¢74.44 million (Net G4O losses)

-

2023: GH¢1.372 billion (GH¢317.69 million Net G4O; GH¢1.054 billion Net G4R)

-

2024: GH¢5.662 billion (GH¢1.822 billion Net G4O; GH¢3.839 billion Net G4R)

Cumulative confirmed losses over the three-year period now exceed GH¢7.1 billion, including ASM-related gold losses of GH¢74 million, GH¢1.52 billion, and GH¢4.84 billion for 2022, 2023, and 2024, respectively.

The Bank emphasized that figures for 2022–2024 are drawn from final audited accounts, while 2025 figures await external audit confirmation. Despite the financial setbacks, BoG defended the programme as a strategic initiative aimed at stabilizing the currency, diversifying foreign exchange reserves, and boosting confidence in Ghana’s economy.