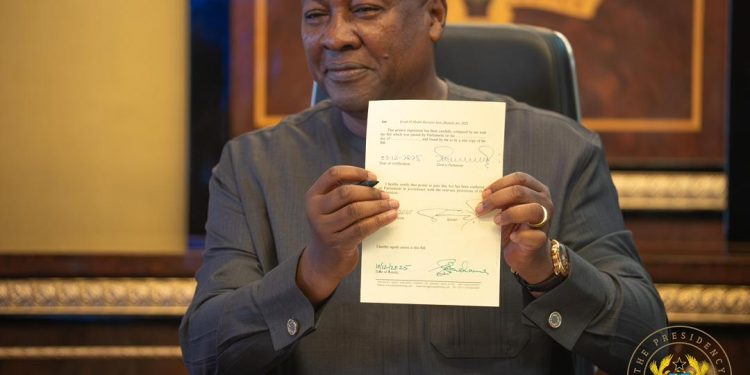

Mahama Signs Law to Scrap COVID-19 Levy Starting January 2026

Government abolishes 1% pandemic-era levy to ease financial burden on citizens

- Mahama signs law repealing the 1% COVID-19 Health Recovery Levy.

- Tax removal takes effect January 2026 to reduce cost of living.

- Repeal forms part of government’s plan to eliminate nuisance taxes.

President John Dramani Mahama has approved the COVID-19 Health Recovery Levy Repeal Act 2025, officially abolishing the 1% levy introduced during the pandemic to support Ghana’s health response.

The repeal, endorsed by Parliament last month, is part of the government’s efforts to eliminate nuisance taxes and ease financial pressure on citizens and businesses.

The levy, established in 2021 under Act 1068, added a 1% charge to the value of taxable goods, services, and imports—except those exempt under VAT regulations. It was applied in addition to VAT, the NHIL, and the GETFund levy, contributing to higher prices for consumers.

Following President Mahama’s assent on Wednesday, the removal of the tax will officially take effect in January 2026, offering relief to households and companies that have long complained about the cumulative weight of consumption taxes.