20% Excise Duty on Fruit Juices Puts 127,000 Jobs and $1bn Export Potential at Risk

Agribusiness Chamber warns tax is crippling juice processors, hurting farmers and weakening Ghana’s global competitiveness

- CAG says juice factories are operating far below capacity due to the excise duty.

- Up to 127,000 jobs and tens of thousands of farming households face losses.

- Chamber urges government to exempt 100% natural fruit juices from the tax.

The Chamber of Agribusiness Ghana (CAG) has cautioned that the government’s 20 percent excise duty on natural fruit juices is endangering up to 127,000 jobs and weakening the country’s prospects of generating as much as one billion dollars annually from juice exports.

In a statement issued on Wednesday, February 4, 2026, the Chamber said the tax, which was introduced as a public health intervention, has instead placed severe pressure on juice processing companies, forcing many to operate at just 30 to 45 percent of capacity, far below the optimal range of 70 to 85 percent.

According to CAG, the reduced processing capacity is already having far-reaching consequences for farmers who depend on these factories as steady markets for pineapples, oranges, mangoes and other fruits.

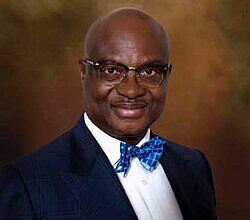

Chief Executive Officer of the Chamber, Anthony Morrison, described the levy as a major threat to livelihoods across the agribusiness value chain.

“The 20 percent excise duty is not merely a tax on juice processors; it is a direct blow to between 50,000 and 120,000 farming households nationwide,” he said. “Farmers are experiencing price drops of 15 to 30 percent, seeing up to 40 percent of their produce go to waste, and losing the security that contract farming arrangements once provided.”

The Chamber noted that women, who account for about 55 to 60 percent of fruit producers, are bearing the brunt of the impact. It added that the slowdown in processing activities is also reducing employment opportunities for young people and contributing to economic decline in key fruit-growing regions, including the Eastern, Volta and Central regions.

Beyond domestic concerns, CAG warned that the tax is undermining Ghana’s competitiveness on the international market, at a time when global demand for natural and functional beverages is expanding rapidly.

“Worldwide demand for natural juices is growing at between six and eight percent each year. Ghana has the potential to earn between 700 million and one billion dollars from exports, but this excise duty is eroding our ability to compete,” Morrison stated.

The Chamber is therefore calling on government to immediately exempt 100 percent natural fruit juices from the excise duty, warning that continued enforcement of the tax could result in significant job losses, reduced farmer incomes and a missed opportunity for Ghana to strengthen its position in the global juice market.